The following information has been extracted from the Australian Treasury website, Services Australia and Service NSW website:

DISASTER PAYMENT

A covid-19 disaster payment is available to workers who have been directly affected by lockdowns and restrictions in Covid-19 hotspots.

First and second period

You’ll get the following amount for the first and second period of a restricted movement order.

If you lost less than 20 hours work per week, you’ll get $325 for each relevant period, if you're eligible.

If you lost 20 hours or more of work per week, you’ll get $500 for each relevant period, if you're eligible.

Third period and beyond

You’ll get the following amount for the third and later periods of a restricted movement order from:

If you’re eligible, you’ll get $375 for each relevant period if you lost either:

If you lost 20 hours or more of work per week, you’ll get $600 for each relevant period, if you’re eligible.

A full day of your usual work is what you were scheduled to work but could not because of a restricted movement order. This includes not being able to attend a full time, part time or casual shift of less than 8 hours.

You can check the key eligibility dates for who can get it.

The COVID-19 Disaster Payment is a taxable payment. This means you’ll need to include it in your income tax return.

Services Australia can pay it from the date of activation for an area where both of the following apply:

Who can get it

You must meet all eligibility rules to get the COVID-19 Disaster Payment. You can get it even if you’re eligible on only one day of the relevant event dates.

To get the payment, you need to meet the general eligibility rules and any rules for the COVID-19 health order that affected you.

If you’re a member of a couple, you can both claim this payment. You and your partner will need to make separate claims.

You can get this payment even if you’re eligible on only one day of a recognised COVID-19 period of restricted movement, lockdown or hotspot.

You need to meet all the eligibility rules to get the payment.

To get it you must meet all of the following:

you're an Australian resident or hold an eligible working visa

you're 17 years or older

you're not getting an income support payment, ABSTUDY Living Allowance, Dad and Partner Pay or Parental Leave Pay

you're not getting the Pandemic Leave Disaster Payment, a state or territory pandemic payment or a state small business payment for the same period

you live in, work from or have visited a Commonwealth-declared COVID-19 hotspot

you live in, work from or have visited a location subject to a state or territory restricted movement order

you had paid employment and because you were in the COVID-19 hotspot or are subject to restricted movement, you can’t attend work on or after day 8

you’ve lost income on or after day 8 and don’t have any appropriate paid leave entitlements

if you are claiming for a period prior to the third week of lockdown, you have liquid assets of less than $10,000.

Liquid assets are any funds readily available to you in cash or savings, or assets that can easily be changed into cash. For example, money loaned to other people.

You’ll also need to meet any rules for the COVID-19 health order that affected you. These rules depend on where you live, work or visited, and the date you were affected.

Read about the eligibility rules and relevant dates for events in the following states:

PANDEMIC LEAVE DISASTER PAYMENT

The Pandemic Leave Disaster Payment is a payment of $1,500 to provide financial support to individuals who cannot work and earn income because they are directed by a state or territory health official to self-isolate or quarantine as a result of COVID‑19.

An individual is eligible if they:

test positive to COVID-19; or

are identified as a close contact of a confirmed case; or

are caring for a child 16 years or younger who tested positive to COVID-19; or

are caring for a child 16 years or younger who is a close contact of a confirmed case; or

are caring for a person who has tested positive to COVID-19.

Pandemic Leave Disaster Payment is available for each 14-day period an individual is directed to self-isolate or quarantine. The Payment is open to Australian residents and holders of a visa that grants the right to work in Australia.

From 1 April 2021, the Government permanently increased the base rate of working age income support payments by $50 per fortnight, and permanently increased the income free area for JobSeeker Payment, Youth Allowance (Other), and Parenting Payment Partnered to $150 per fortnight, allowing recipients to earn more each fortnight before their payment reduces.

For more information, visit https://treasury.gov.au/coronavirus/households

How to Claim

If you’re an Australian resident

Australian residents need to claim online.

To claim online you need a myGov account linked to a Centrelink online account. If you don’t have a myGov account, you can create one.

If your myGov account isn’t linked to Centrelink, you can prove who you are through myGov to link to Centrelink (see screenshot below).

Steps:

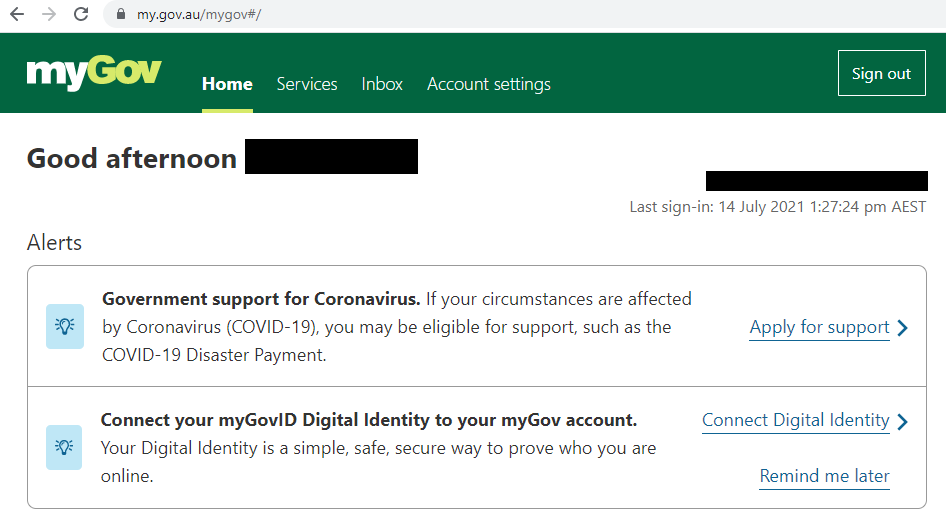

Select “Apply for Support”

Click on “Get Started” under the “Affected by coronavirus (COVID-19)” box

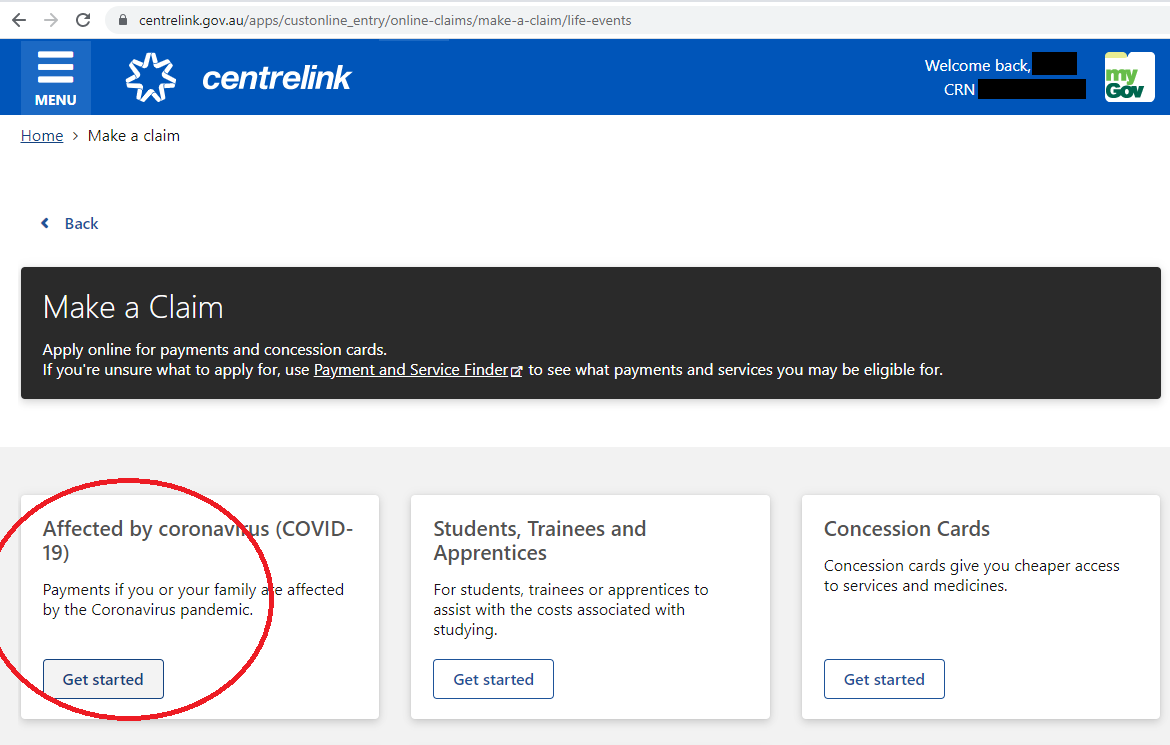

Click on “Apply for Covid-19 disaster payment”

Follow the application step by step until the claim has been completed.

Please be aware that making false declarations is a Federal crime. Check eligibility criteria above before making the claim.